New Credit Card Interest Structure – No more interest free period for credit card users who make partial payment

Are you one of the Credit Card user who always perform prompt payment for the past 12months? Then you are safe and you will save yourself some interest rate too! I’m one of them. Haha, so I get to enjoy the 20 days free interest and low interest rate?

But what’s the point of doing that? Ppl use Credit Card because the no money or want to use future money and now they implement this and of the current petrol and price hike? Are you happy with the new Credit Card Interest Structure? For me, I use Credit Card for convenient sick and sometimes got offer for card member too and to collect points too of coz =)

What say you? Are you paying extra because of this new credit card interest structure?

PETALING JAYA: From Tuesday, credit card holders who make the minimum or partial repayment on their outstanding amount monthly would no longer enjoy the 20-day interest-free period for new retail transactions.

Those who settle their credit card outstanding amount in full every month will continue to be granted the interest-free period.

Bank Negara confirmed that the ruling took effect Tuesday as part of its effort to promote the use of credit cards as a payment instrument, and to encourage prudent spending and good financial discipline.

A year ago, Bank Negara took the initial step, announcing a new interest rate scheme for credit card users. Credit card issuers then began tracking the repayment behaviour of their cardholders from July 1 last year.

In a statement Tuesday Bank Negara said: “More than half the cardholders pay at least the minimum amount due and roll over the remaining balance.”

For credit card users with a good record of settling their credit card balances due each month promptly for 12 consecutive months, the finance charge will be reduced from the maximum of 18% a year to not more than 15%, it added.

As at the end of last year, one third of the 2.7 million credit card holders in the country settled their outstanding amount in full every month.

Bank Negara said banks and credit card issuers had already begun notifying their customers on the matter.

A spokesman for Public Bank Bhd said the bank had notified its credit card holders on the scheme in June and July last year and again in April, this year.

“We gave them ample notice because we needed to track their 12-month repayment behaviour history,” she said, adding that the bank had 900,000 credit card holders.

source : TheStar

Some useful information forwarded from my friend and it’s a good read. Just click on the image to enlarge if you can’t read.

CitiBank Card Member:

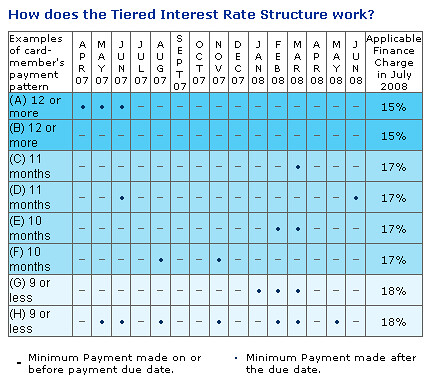

Citibank credit cards are designed with benefits that allow you to enjoy and live life to its fullest. As such, effective 1 June 2008, Citibank will introduce a new Tiered Interest Rate Structure on retail purchases in line with the latest guidelines by Bank Negara Malaysia.

This Structure has been introduced to inculcate prudent financial management among our credit cardmembers. Cardmembers who demonstrate good track record in settling at least their minimum payment promptly will enjoy reduced finance charges.

The table below illustrates the interest rate tiers and how you can enjoy the lower rates:

15% per annum – Cardmembers with prompt payments for 12 consecutive months.

17% per annum – Cardmember have to make 10 or 11 times prompt payments in the last 12 months.

18% per annum – Cardmembers will be charged this rate if they have only made 9 or less prompt payments in the last 12 months.

Are there any other changes?

Yes, there are changes on the Late Payment Charges and Interest Free Period.

• Late Payment Charges

Cardmembers have to pay a minimum of RM10 or 0.5% of the total outstanding balance as at statement date, up to a maximum of RM100.

• Interest Free Period

The Interest Free Period for retail transactions will be 20 days from the statement date and is applicable only for cardmember who pay in full on or before the payment due date. If cardmember opts to pay partial or minimum payment, finance charges for retail transactions will be calculated from the day the transactions are posted to the card account.

FAQ

Frequently Asked Questions From CitiBank

1. By July 2008, I would have been making all my payments on time for the period July 2007 – June 2008 and have never been late even once, what will be the finance charge in my July 2008 statement?

As you have been paying promptly every month (either by clearing your balances or just the minimum payment due) you will enjoy a finance charge of 15% per annum.

The New Interest Rate Structure has been designed to reward credit cardmembers who demonstrate a good track record of paying their credit card bills promptly each month.

2. Six months ago, I made a late payment. In this case, what will be the finance charge reflected in my upcoming statement?

If you have made one late payment in the last 12 months, you will enjoy a finance charge of 17% per annum.

The finance charge of 15% per annum will only apply if you consistently settle your balances or make the minimum payment due on or before the payment due date for 12 consecutive months.

3. I think I may have missed my credit card payments for one or two months in the last 12 months. What will be the finance charge rate reflected in my next credit card statement?

You will enjoy a finance charge rate of 17% per annum. This finance charge is applicable for a maximum of 2 late payments made in the last 12 months.

However, if you consistently pay on time before the payment due date in the next 12 months, your interest rate will be changed to 15% per annum. Credit cardmembers who demonstrate good financial discipline and prudent financial management will be suitably rewarded.

The credit card is a payment tool. Using credit cards wisely involves choosing a card that best suits your lifestyle, keeping track of how much you spend and how much you pay. It is advisable that you treat your credit card as how you would treat a bank loan of the same amount. As such, you must ensure that you pay your bills promptly every month, to avoid higher finance charges.

4. I have been making all my payments on time except for the last 3 months, what is the finance charge that I have to pay now?

We understand that you may have had some difficulties in paying your balances promptly in the last three months. Due to this, your finance charge rate will be 18% per annum.

However, if you consistently pay on time before the payment due date in the next 12 months, this rate will be changed to 15% per annum. This would be your reward for demonstrating good financial management over the course of 12 months.

To help you achieve this, review and organize your finances as well as keep a budget. A budget is a powerful tool to help you achieve financial goals. It can help you get control of your finances, keep out of financial trouble, become a smarter consumer, and pave the way to a secure future.

5. How long does the cheque take to be processed from the point that the cheque is received by your bank?

Between 2 to 3 working days.

6. When do you recommend me to make full payment to enjoy the 20 days interest free period?

If you are making payments online or GIRO, please do so at least 1 day before the payment due date.

If you are planning to drop the cheque at any of our branches or cheque drop box, please do so at least 2 working days from the payment due date.

If you are paying by mailing the cheque, do send it at least 1 week before the payment due date.

If you are making cash payment, you may do so latest by the payment due date.

17,232 views

17,232 views

July 3, 2008

Credit card companies are kind of like a resturant you bought a steak sandwich and while you are eating it they tell you the price just doubled and you are kind of screwed but the government sits back on their fat ass heads and don’t do anything to stop it. Their all getting a kickback in their pockets from someone.This whole thing is a bunch of rubbish and someone needs to put a stop to it.Hopefully soon.

September 11, 2008

Not good.. I owed them RM 10 last month (due to max RM 5000 transfer), and got charged interest this month of RM 50 because of my new expenses this month which I’ve not receive the bill until its too late.

Advice:

1) Travellers don’t use credit card unless you are sure you are able to make prompt payment

2) If you forgot to pay IN FULL last month, don’t buy anything early this month until towards your statement date

October 5, 2009

Any idea if the credit card is renewed? The interest rate would be re-count or continues if I maintain the good payment behaviour?

October 6, 2009

Hi TB,

I have no idea, the best is call their customer service =)